Capital gains tax calculator shares

For example if you purchased shares for 1200 and sold them a few months later at 2200 the capital gain realised would be 1000 and you would need to pay tax on that. Let us compare the long-term capital gains tax on both the figures.

Uk Hmrc Capital Gains Tax Calculator Timetotrade

Capital Gain Tax Calculator for FY19.

. 2021 capital gains tax calculator. You can use the calculator if you sold shares that were. If the sale price exceeds the shares purchase price the difference is the profit or capital gains earned on the sale of shares.

But when you add the 100000 of taxable capital gains from the asset sale this. Calculate the Capital Gains Tax due on the sale of your asset. 246366 Long-term capital gains tax 10.

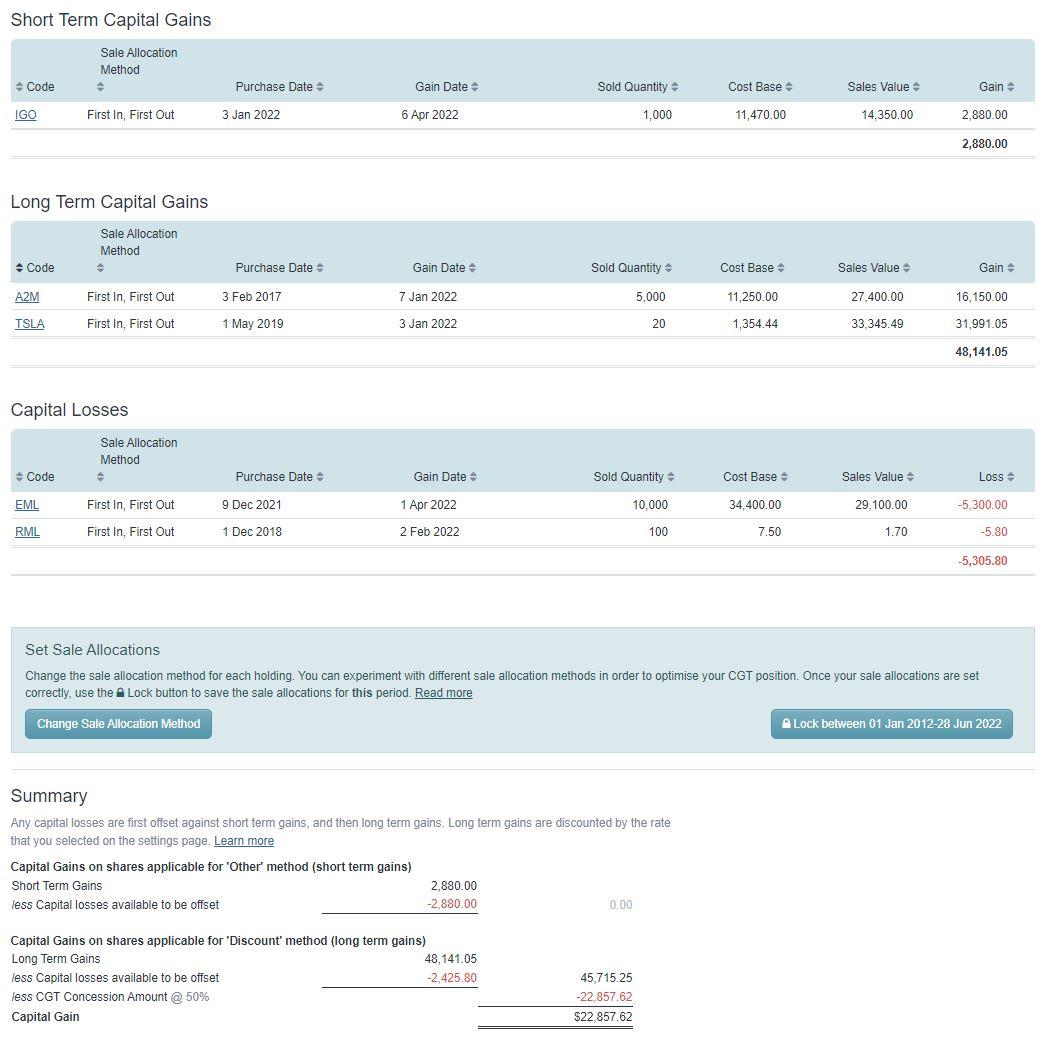

Sharesights award-winning investment portfolio tracker includes a powerful Australian capital gains tax report that functions as a CGT calculator determining capital gains made on sold. The short-term capital gains on the transaction will be calculated as below. Taxes on capital gains for the 20212022 tax year are as follows.

Your entire capital gain will be. Assuming annual income of 100000 you will pay capital gains tax of 15000 100000. Amount Rs The full value of the consideration received 1000 shares180.

As part of this there is a long-term capital gains tax which is a 20 tax on investments held for more than. Oregon Capital Gains Tax Calculator will sometimes glitch and take you a long time to try different solutions. The difference is then subtracted from the cost basis of the asset.

LoginAsk is here to help you access Oregon Capital Gains Tax Calculator. If you own the asset for longer than 12 months you will pay 50 of the capital gain. A 10 tax rate on your entire capital gain if your total annual income is less than 50270.

The same type acquired in the same company on the same date. But when you add the 100000 of taxable capital gains from the asset sale this. Investments can be taxed at either long term.

Rhis capital loss on. In the example above if you just earned 85000 a year before tax your marginal tax rate is 325. Long-term capital gains tax 20 with indexation - Rs.

If you earn 40000 325 tax bracket per. The Capital Gains Tax Return BIR Form No. Use the calculator or steps to work out your CGT including your capital proceeds and cost base.

The difference between the price at which you purchased the property and the exact cost is the gain. In this case to calculate the LTCG on shares purchased the indexed purchase price of the asset needs to be calculated. Calculate the Capital Gains Tax due on the sale of your asset.

2022 capital gains tax rates. Your total capital gains. The grid below depicts the calculation of capital.

Capital gains are taxed at the same rate as taxable income ie. 123183 x 20 100 Rs. It automatically uses the 2022 federal tax brackets on the capital gains.

Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Cost Inflation Index CII from 2015-16 to 2019-20.

1707 shall be filed in triplicate by every natural or juridical person resident or non-resident for sale barter exchange or other onerous disposition. Calculate Capital Gains Tax. FAQ Blog Calculators Students Logbook Contact LOGIN.

Since you owned the home for more than a year long-term capital gains tax rates apply. The highest-earning people in the United States pay a 238 tax on capital gains. You pay tax on your net capital gains.

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

How To Calculate Long Term Capital Gains Tax Capitalmind Better Investing

Capital Gains Tax What Is It When Do You Pay It

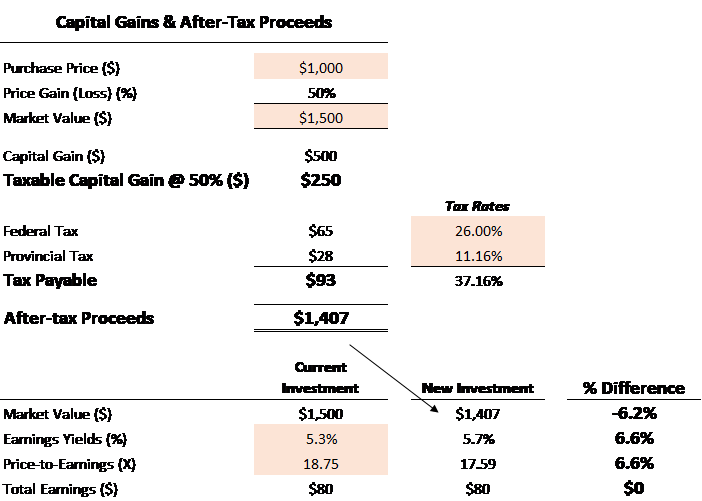

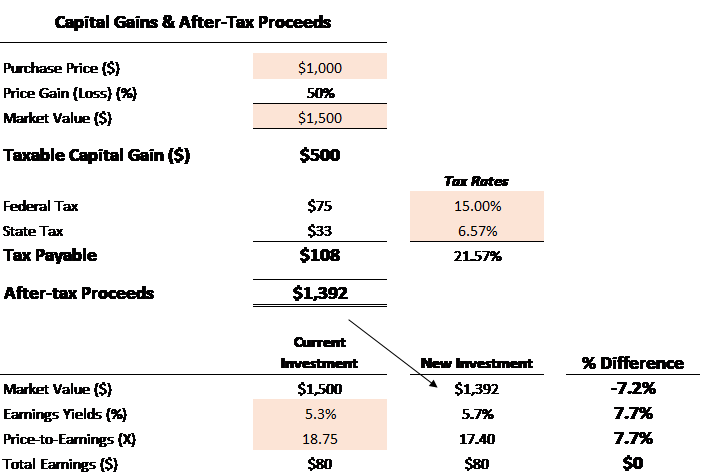

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Yield Cgy Formula Calculation Example And Guide

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Uk Hmrc Capital Gains Tax Calculator Timetotrade

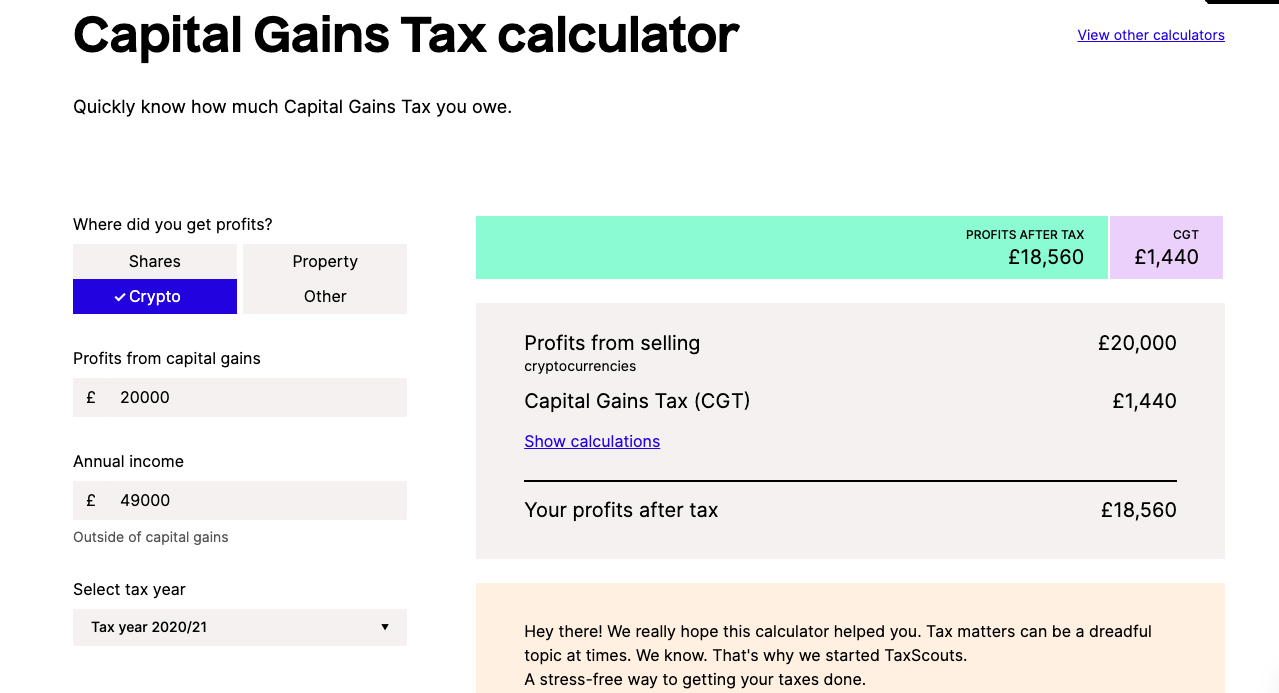

Best Bitcoin Tax Calculator In The Uk 2021

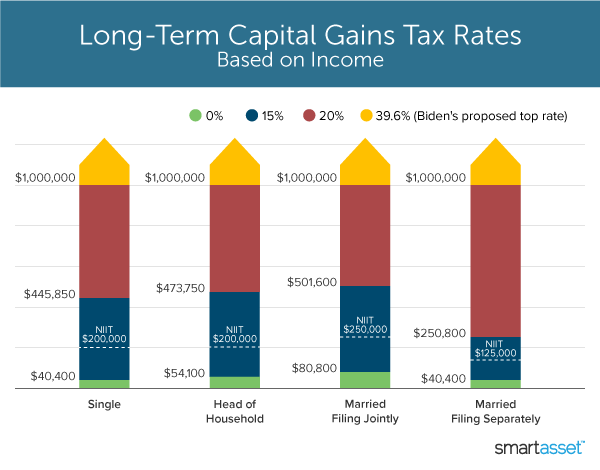

What S In Biden S Capital Gains Tax Plan Smartasset

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Capital Gains Tax Calculator 2022 Casaplorer

Capital Gain Tax Calculator 2022 2021

Capital Gains Tax Cgt Calculator For Australian Investors

Long Term Capital Gain Tax Calculator In Excel Financial Control

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Tax 101

Long Term Capital Gain Tax On Share And Mutual Fund Excel Calculation To Find Ltcg Of Mutual Fund Youtube